trust the professionals with 20+ years of experience for your tax needs.

Call today for FREE consultation! Once we prepare your taxes, there will be NO refunds! We do NOT do estimates.

.jpg/:/)

Call today for FREE consultation! Once we prepare your taxes, there will be NO refunds! We do NOT do estimates.

.jpg/:/)

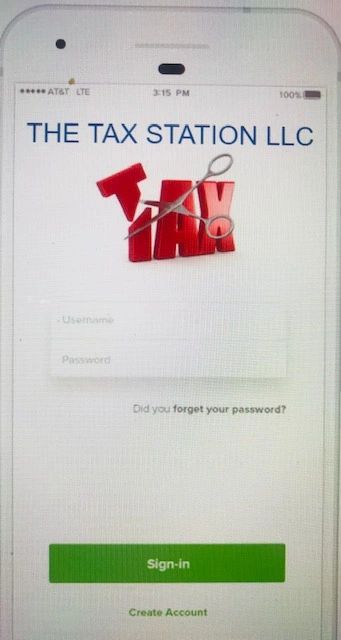

In order to reduce the risk of spreading COVID-19 , we ask that you use our secure app to upload your documents to me for fast and friendly tax preparation service.

https://taxestogo.com/App/Download/80185

✅ Always Confirm I Received your file by texting me once it has been submitted and says waiting on preparer.

*(prices subject to change without notice)

Additional forms , call for quote

Additional forms , call for quote

Additional forms , call for quote

Add a footnote if this applies to your business

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test:

To claim your child as your dependent, your child must meet either the qualifying child test or the qualifying relative test:

In addition to meeting the qualifying child or qualifying relative test, you can claim that person as a dependent only if these three tests are met:

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to Dependents under Who Must File in Publication 501, Dependents, Standard Deduction and Filing Information. You can also refer to Do I Need to File a Tax Return? to see if your income r

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to Dependents under Who Must File in Publication 501, Dependents, Standard Deduction and Filing Information. You can also refer to Do I Need to File a Tax Return? to see if your income requires you to file.

Even if you don't have to file a federal income tax return, you should file if you can get money back (for example, you had federal income tax withheld from your pay or you qualify for a refundable tax credit). See Who Should File in Publication 501 for more examples.

No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe. Because your refund isn't applied toward your regular monthly payment, continue making your installment agreement payments as scheduled.

If your refund exceeds your total bal

No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe. Because your refund isn't applied toward your regular monthly payment, continue making your installment agreement payments as scheduled.

If your refund exceeds your total balance due on all outstanding tax liabilities including accruals, you'll receive a refund of the excess unless you owe certain other past-due amounts, such as state income tax, child support, a student loan, or other federal nontax obligations which are offset against any refund. For more information on these non-IRS refund offsets, you can call the Bureau of the Fiscal Service (BFS) at 800-304-3107 (toll-free).